Food for thought

PORTFOLIO JOHN BULL

In -the few months that I have held Associated British Foods, the shares have drifted away so that I now show a small loss. I bought them (for my first portfolio) because there seemed to have been something of a manage- ment renaissance and because I was impressed by the growing proportion of group profits contributed by the supermarket interests (Fine

Fare). Now a leading firm of London.brokers has published the results of a-detailed analysis of the company and 1 am pleased to find that it fortifies my faith. The shares remain a-hold —or even a buy.

I start with Panmure Gordon's estimates for profits this year and next. The first calcula- tion should be pretty reliable because • the chairman has provided a broad indication. Taking into account the rise in corporation tax (and some changes abroad) the answer is an 11 per cent improvement in earnings. The figuring for the year which ends on 31 March 1970 is more speculative. It takes into account the recent increase in the price of bread, ex- pansion of Fine Fare plus Cussons (recently bought from Sir Isaac Wolfson) and something of a setback in the poultry division (chicken prices have been down). This all adds up to a further increase in earnings—by just under .10 per cent taking a pessimistic view.

For the long-term investor, however, there are some rather broader considerations to take into account. Associated British Foods is a very large group (an annual turnover of some £500 million) in the midst of some important changes. In time (that is, over a longer period than the next eighteen months covered by these profit projections) the group's investment stand- ing could be transformed. The real value of the Panmure Gordon assessment is that it pro- vides more information than has been available hitherto on basic trends.

In the United Kingdom, the company's management structure has been considerably reformed over the past two years (since Mr G. H. Weston succeeded his father, Garfield Weston, as chairman). in place of an untidy organisation reflecting AB Food's history rather than its prospects, the operation now falls into nine divisions—which I list in order to show the breadth of activity: mills, bakeries (`Sun- blest' bread and the aric shops in London), biscuits (`Ryvita' and many of Marks and Spencer's biscuit lines), a mixed division of minor food interests (including jam and meat products), Twining Crosfield (tea and coffee), Allied Farm Foods (Nitrovit and - Buxted chickens), Food Securities (food wholesaling), supermarkets (Fine Fare, Melias and Cussons), Crusador Vendors (automatic food- and drink- vending machines) and, finally, the overseas division. That is, I think, an impressive list. From the point of view of the stock market, it is important to know what proportion of total profits each division contributes. Because of price control, the bakery business is not well regarded in the City. Supermarkets, on the other hand, have become a glamour section. According to Panmure Gordon `the most important trends have been the decline in the Proportion of sales and profits contributed thy the bakeries as a result of the dramatic growth in An Food's overseas interests, and the addi- tion of a substantial milling division and a highly profitable grocery division in the United Kingdom.' In 1961-62 around 80 per cent to 90 per cent of group profits were provided by the UK bakeries. Flour requirements were bought in mainly from abroad, whereas now they are fully •satisfied by a substantial home milling operation. More to the point, this year the mills and bakery divisions will bring in only about 35 per cent of group profits. The UK grocery division (mainly Fine Fare) adds another 20, per cent. And the overseas interest stands to.chip in a staggering.40 percent. This very large overseas interest has been unappre- ciated in the stock market. It chiefly com- prises investments in South Africa, Australia and New. Zealand.- What, though, does all this mean for the investment standing of the group? At 9s 6d the shares are selling at seventeen times last year's likely profits and at a rather smaller multiple of this year's. Against the sort of background I have sketched in, that does not seem to me to be an extravagant rating, indeed it is modest.

I said last week that London and County Securities, the commercial banking group, would be worth buying at up to 20s a share when dealings began. In the event the first price over the ticker-tapes last Tuesday was 28s and they quickly moved up to 31s. I know this company well and am bound to say .that such prices are ridiculous except for investors willing to look a very long way into the future. Regretfully, therefore, I have not added any shares to my portfolio If the market in London and County cools down a little, then I shall re-examine the situation.

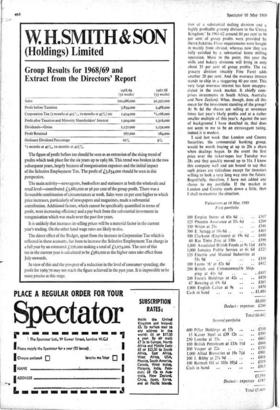

Valuations at 14 May 1969

• First portfolio 100 Empire Stores at 61s 6d £307 125 Phoenix Assurance at 33s 6d .. £209 330 Witan at 2Is £346 500 E. Scragg at 18s 6d .. • .. £463 500 Clarkson (Engineers) at 19s 6d .. £488 60 Rio Tinto Zinc at 130s f390 1,000 Associated British Foods at 9s 13d £456 1,000 Jamaica Public Service at 6s 6d £325 133 Electric and Musical Industries at 53s 9d 35 100 Lyons 'A' at 8. 2s 6d.. ££4182 200 British and Commonwealth Ship- ping at 4Is 6d .1415 200 Forte's Holdings' at 42s .. £420 67 Bowring at 49s 6d £165 1,000 English Calico at 9s .. £450 Cash in hand .. £1,484 £6,688 Deduct : expenses £246 Second portfolio Total £6,442 600 Pillar Holdings at 17s •-• .. •• £510 15 Kaiser Steel- at £39 12s .. .. £595 250 Lonrho at 53s .. £662 100 British Petroleum at 133s 1 Id . £666 300 Vosper at 22s .. . • .. £330 1,000 Allied Breweries at 19s 74d .. £981 300 J. Bibby at 27s 9d .. £416 100 Burmah Oil at 103s 10fd £519 Cash in hand .. • • • • £915 £5,594 Deduct : expenses £185 Total £5.409

Previous page

Previous page