Portfolio

Selling Out

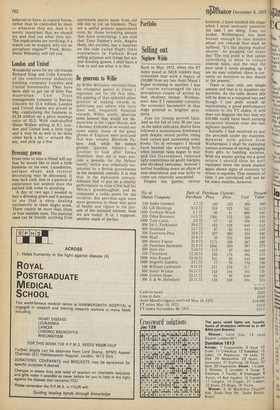

Nephew Wilde Back in May, 1972, when the FT index stood at 543.6 readers may remember that with a legacy of E10,000 from my late Aunt Maud I began investing in equities. I was of course encouraged on this precipitous course of action by that ebullient broker, Wotherspool. Also if I remember correctly the economic barometer at that stage pointed to brighter prospects. Alas my timing proved fatal. And as the fall of over 30 per cent in the index indicates, shares have followed a monotonous downward path despite record profits, rising land values and increasing order books. Yet in retrospect I should have heeded the warning bells when interest rates began to soar and the Government imposed tight restrictions on profit margins and dividend restraints. Instead I battled headlong down an abyss of near-destruction and was lucky to come out relatively unscathed. Despite this pyrrhic victory however, I have reached the stage when I must seriously question the task I am doing. Even my broker, Wotherspool, has been honest enough to cast doubts about low rewards that must be suffered. "It's like playing musical shares" he quipped the other day."The real point is that unless something is done to reduce interest rates, and the way the poor tired E needs propping up I see no easy solution, there is certainly no incentive to buy shares at the present."

There is thus only one simple answer and that is to liquidate my portfolio. As the table shows this will be done at a marginal loss and though I can pride myself on maintaining a good performance relative to the FT index, it still does not disguise the fact that my E10,000 could have been earning attractive interest over the last eighteen months.

Initially I had resolved to put the proceeds under my mattress. However with advice from Wotherspool I shall be exploring various avenues of saving, ranging from gilts to building societies., With my money giving me a good return I should thus be well equipped when the stock market again shows signs of recovery to return to equities. That moment of time, I am convinced will not be for some months, however.

Previous page

Previous page