The New Balancing Act

By NICHOLAS DAVENPORT Tins is the season of. the year when the Treasury takes the centre of the national stage and performs its an- nual turns—the balancing of payments, the economic sur- veying and finally the budget accounting. I wish I could give it a good review, for spring is here, the pay pause has ended and charitableness is more becoming, but alas! I have never seen such a sad pianissimo, rallcntando affair as the balancing of payments overture. The poor Treasury has had to confess that it could not repeat the dramatic fortissimo opening of a Year ago. You will remember that at that time it electrified the public by loudly declaring that our international trading account was running a terrific deficit—no less than £344 million. Well, it was all greatly exaggerated. The real deficit for 1960 was only £288 million and the flak:it for 1961 was only £70 million instead of the £150 million-odd we had been led to expect. The main cause of this welcome improvement %vas the identification of certain commissions on Imports now included in the 'invisible' account.

REVISED BALANCE OF PA VNILN•TS IN MILLIONS

Now the fascinating. part of this disclosure is that in July last, when Mr. Lloyd was announc- ing an economic crisis, raising Bank rate to 7 Per cent. and imposing his `little' Budget of austerity, the international trading account was already taking a turn for the better; it actually secured a small surplus, in the last quarter, bringing the deficit for the half-year down to a mere £10 million. Of course, the foreigners who had been running out of sterling were not aware of this in July. Nor was there any cause for complacency on our part seeing that exports

1959 1960 1961 Visible trade Balance ... —104 —391 —135 'Invisible' Balance ... +219 +103 • + 65 Current Trading Balance ... +115 —288 — 70

remained stagnant and the smaller deficit on visible trade was due entirely to de-stocking and a further improvement in the terms of trade. But it is now clear that there was no excuse (as I have argued before) for Mr. Lloyd's delay in reducing Bank rate when the exchange crisis had been overcome and the backing of the IMF secured. He must have been told by his statisti- cians six months ago that the current trading position was not as black as he or they had imagined. Yet it was nearly eight months before he restored Bank rate to 5 per cent.—a long enough time to bring gloom and despondency to businessmen and exporters and cause them to cut their plans for new industrial investment. If he was using a high Bank rate simply as a weapon in his `pay pause' campaign he was taking grave economic risks. Clearly he must now use the Budget as an opportunity to undo the harm he has already done to the economy.

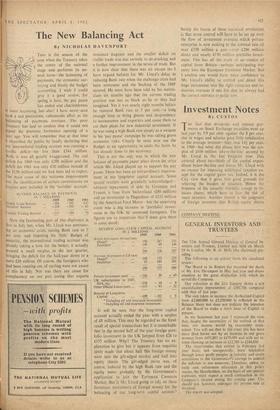

This is not the only way in which the new balance of payments paper plays down the crisis which Mr. Lloyd played up to support his pay pause. There has been an extraordinary improve- ment in our long-term capital account.. Some special receipts were gratefully acknowledged— advance repayments of debt by Germany and France, a loan from Switzerland (£90 million) and an investment in Dagenham of £131 million by the American Ford Motor--but the surprising event was a big increase in 'portfolio' invest- ment in the .UK by unnamed foreigners. The figures are so important that I must give them in some detail:

REVISED LONG-TERM CAPITAL ACCOUNT IN MILLIONS • Excluding oil and insuranWinvestmeni. t Including oil and insurance investment.

It will be seen that the long-term capital account actually ended the year with a surplus of £8 million. This may be regarded as the freak result of special transactions but it is remarkable that in the second half of the year foreign port- folio investment in the UK jumped from £26 to £155 million. Why? The Treasury has no ex- planation to give but it appears from inquiries lately made that about half this foreign money went into the gilt-edged market and half into equity shares. The gilt-edged move was, of course, induced by the high Bank rate and the equity move probably by the Government's application to join the European Common Market. But is Mr. Lloyd going to rely on these fortuitous movements of foreign money for the balancing of our long-term capital account? British inve.siment Abroad (net)

Direct* ... ••• Portfoliot 1959 196 148 344 1960 247 89 336 1961 211 146 357

Overseas Investment in UK (net)

Direct* ... 146 135 225 Port fo lot 52 102 181

198 237 406 Private Insesunent (net) ... —146 — 99 + 49 UK subscriptions to IMF, IDA, etc. ••• ••• —236 — 10 — 9 Other Official Loans (net) ... —117 — 93 — 32 Balance of Long-term

Capital ... —499 —202

+ 8

Surely the lesson of these statistical revelations is that some control will have to be set up over the flow of investment overseas which private enterprise is now making at the colossal rate of over £350 million a year—over £200 million direct and nearly £150 million portfolio invest- ment. This has all the mark of an exodus of capital from Britain—perhaps anticipating our entry into the European Common Market. But I confess one would have more confidence in Mr. Lloyd's ability to control and direct this huge investment into the right countries and in- dustries overseas if one felt that he always had the correct statistic; to guide him.

Previous page

Previous page