Investment Notes

By CUSTOS

THE improvement in the £ and the statement by the US Secretary of the Treasury, Mr. Douglas Dillon, that Britain seemed to have overcome her short-term financial crisis, imparted a better tone to the gilt-edged market. In view of the coming reduction in Bank rate, the im- provement should be extended. A rally could also be extended in equity shares. The Chancellor, we know, is more optimistic. 'Signs of improve- ment are already to hand,' he said, 'production is beginning to move up and one reason for this increase is a rise in exports. The time is not far distant when we shall be able to reduce the import charges without endangering our eco- nomic position.' This would greatly relieve our exporters, who are beginning to fear retaliation by our customers in Europe.

Exporter Shares

Last week I called attention to a number of companies which export a high percentage of their output and may be expected to benefit from the Government's tax rebate. Another firm of brokers has produced a further list of corn- panics which would benefit greatly by the export rebate scheme.

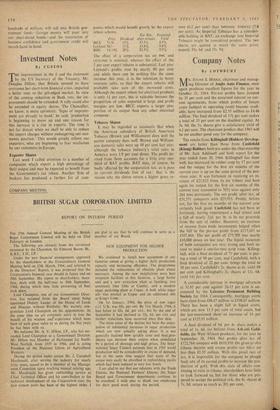

Est. Div. Potential Price Dividend al ler rebates Yield

B1CC 71/6

15% 17.5% 4.9% Leyland 56(- 11%

13.4% 5.0%

BMC 14/10+ 20%

23.5% 7.9%

The effect of a corporation tax on BMC and LEYLAND is minimal, whereas the effect of the 2 per cent export rebates is substantial. Last year Leyland's profits rose by nearly 80 per cent .and while there can be nothing like the same increase this year, it is the intention to boost overseas sales, so that the export rebates will probably take care of the increased costs. Although the export rebate for electrical products is only 11 per cent, this is valuable because the proportion of sales exported is large and profit margins are low. BICC exports a larger pro- portion of its output than any other electrical company.

Tobacco Shares

It may be regarded as axiomatic that when the American subsidiary of British American Tobacco (Brown and Williamson) does well the parent company does well. Brown and William- son domestic sales were up 10 per cent last year, although the tobacco industry's total sales in America were 1.9 per cent down. The profit de- rived from them accounts for a little over one- third of BAT profits. BAT may, of course, be badly affected by the corporation tax, as it pays its current dividends free of tax: that is the reason why the shares return a higher gross re- turn (6.2 per cent) than IMPERIAL TOBACCO (5.8 per cent). As Imperial Tobacco has a consider- able holding in BAT, an exchange into Imperial Tobacco might be considered prudent. The two shares are quoted at much the same price, namely 53s. 6d. and 53s. 9d.

Previous page

Previous page