RAND MINES RESERVES

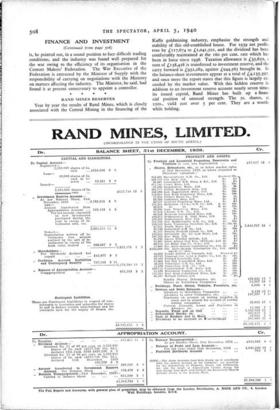

Year by year the results of Rand Mines, which is closely associated with the Central Mining in the financing of the Kaffir goldmining industry, emphasise the strength and stability of this old-established house. For 1939 net profits rose by £117,674 to £1,041,501, and the dividend has been comfortably maintained at the 16o per cent. rate which has been in force since 1936. Taxation allowance is £35,652, a sum of £138,428 is transferred to investment reserve, and the carry forward is £952,289, against £944,565 brought in. In the balance-sheet investments appear at a total of £4,135,397. and once more the report states that this figure is largely ex- ceeded by the market value. With this hidden reserve ir addition to an investment reserve account nearly seven times its issued capital, Rand Mines has built up a finan- cial position of unusual strength. The 5s. shares, at 15os., yield just over 5 per cent. They are a worth- while holding.

Previous page

Previous page