THE MONEY MAWKET.

STOCK EXCHANGE, FRIDAY EVENING.—There has been rather more business in our Stock Market this week than last week ; but when we speak of it in comparison with former times, under similar circumstances, we should say there is nothing, absolutely nothing going forward. Money is still scarce out of doors, but in the Stock Exchange has been more plen- tiful within a day or two. Stock is abundant ; and we have had, besides the ordinary supply, one or two considerable sales on account of the Savings Banks. Yet the tendency of the Market is rather upwards. Exchequer Bills have improved, and are worth from59 to 61. Consols, on Monday, were the whole day at 871 to ; on Tuesday and Wednesday, at 871 to ; yester- day, 871 to 1- ; and to-day, 87i to 4. These variations are too trifling for comment ; but it is worthy of remark, that the last price is the highest of the whole Account. The New 4 per Cents. have likewise improved about f per cent. since Saturday last.

In the Foreign Market, Russian and Danish Stock have both:advanced,. the former to 9(1, and the latter to 64, both exclusive of dividends. French Stocks promise to verify the opinion which we expressed some

raonth4 ago, They havesteadily and materially advanced since then; and the 3 per Cents, are now only 8 per cent, lower than our own Consols. i

The latest prices from Paris s that of the 1st instant, when the 5 per Cents. were quoted at 108f. 80c., and the 3 per Cents. at 791. 55c., which is the highest price they have ever reached. This continued advance of the French Funds is perhaps one cause of the firmness of our own; which might. it is thought, have otherwise been materially lower. In the South American Market, we regret to say there is no improve- ment. Peruvian Bonds have been sold at ; Colombian at 16 (the first Joan indeed at 14); Mexican at 214 ; Chilton 201. Every succeeding sale is effected on lower terms than the last; and the latest prices are the lowest which these Bonds have ever been sold at at all. Yet there is no Immediate cause for this, so far as we can perceive, except the total aban- donment of hope in the minds of the bondholders.

There has not been much done this week in Brazil Stock The price is now (quoted without the dividend due on the 1st inst. which was paid) at mi. Buenos Ayres is about 25; but the Market for either would not sustain any large sale at these prices. Portuguese Stock is about 44. No word now of a dividend. The patience or apathy of the holders of this Stock is truly marvellous. Spanish Bonds 91. to There is no improve- ment in Shares. The holders appear to be actuated by the same feeling which influences the bondholders.

SATURDAY, ONE o'cLoca.-Consols opened at 871 buyers, but imme- diately became sellers : 87i to have been the prices ever since, with little or no business doing.

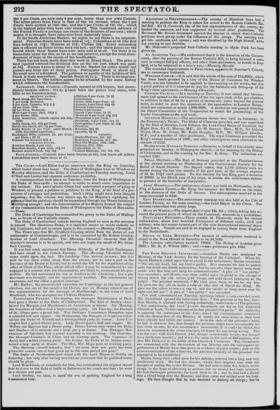

Bank Stotelr,div.Sper Cent. Colombian, 3 per Cent. Reduced, Ditto, 1824, 6 per Cent. 16 8 per Cent. Consols, 871 j Danish, 8 per Cent. 641 65 31 per Cent. 1818, French 5 per Cents. 81'per Cent. Reduced, Ditto 3 per Cents.

New 4 per Cents. 1822, 1021 1 Greek 5 per Cent. 14 15 4 per Cents. 1826, Mexican 6 per Cent 21/ 211

Long Annuities, (which expire 5th Jan. Neapolitan 5 per Cent. 1860) Peruvian, 6 per Cent. 111 12 India Stock, div. 101 per Cent. Portuguese, 5 per Cent. 42 42/

South Sea Stock, div. n per Cent. Prussian, '

India Bonds, (4 per Cent. until 'March, Russian, 951 96

1829, thereafter 3 perCent.) Spanish, 9 92

Exchequer Bills, (interest 2d. per Cent. SHARES. per Diem.) 60 61 Anglo-Mexican, 21/. 231. Consols for Account 87ft 1 Brazilian, Imperial, 471. 491.

FOREIGN FUNDS. Real Del Monte, 1201. 1301.

Austrian Bonds, 5 per cent. Bolanos, 275/. 2851. Brazilian Bonds, ./ per cent. 53i 54 Colombian, 71. SI. Buenos Ayres 6 Cent. 241 251 United Mexican, 101. 10/. 10s.

i Foutt o'ctocx.-Consols have been buyers at 878, but leave off sellers. Colombian have been done at 15.

Previous page

Previous page