Industrial Banking Deposits Reviewed

By J. W. W. HUNTRODS TN all probability, the most remarkable single 'financial development of the present century has been the emergence of a strong group of in- dustrial banking houses. Their importance to the national welfare may be estimated from a recent unsolicited testimonial in the City columns of The Times, which stated that 'there can be no doubt about the role played by hire purchase in getting the economy on the move again.' But while the economic importance of the industrial banker's operations is now fully recognised, the signifi- cance of his role as a collector and lender of the community's savings is much less widely under- stood. In many ways this is hardly surprising. Some of the most experienced industrial bankers have always fought shy of laying claims to any sort of banking function. Moreover, the new in- dustrial banking structure has developed so rapidly that there is no conventional balance sheet pattern by which any individual company may be judged. The lack of an accepted pattern is due mainly to the fact that individual com- panies show wide discrepancies in the relative importance to them of the varying sources from which they obtain money. It is difficult at this point to be dogmatic without being unintention-

ally misleading. Suffice it to say that, particularly before the credit squeeze, there was a marked tendency for the older companies to depend primarily on the clearing bankers and acceptance houses for the bulk of the money which they needed. This should not be taken to mean that deposits were unimportant, but they tended to come in large amounts, chiefly from institutional investors.

The beginning of a widespread public recogni- tion of the essential banking nature of the business was probably sparked off by the remarkable growth of Lombard Banking Ltd. This company was the first to make a powerful effort to attract deposits by advertising, and to place heavy reliance on this source of funds to sustain expan- sion of its assets. This was a courageous experi- ment, for when it was first undertaken, the legal implications of deposit advertising were far from clear. In due course, however, the trail which Lombard had laid was followed by others, and deposit finance assumed a much greater, and per- manent, importance to the more progressive industrial banking houses.

At first, the older and larger companies appeared reluctant to engage in an open drive for

expansion through deposit finance, and some 01 the newer small or medium-sized companies were quicker off the mark. But later on, when the credit squeeze became really intense, advertising for deposits became general. When Bank rate stood at 7 per cent., rates of 8 or 84 per cent were paid by some of the largest and most repot'I able houses, while some small institutions paid 9 or even 91 per cent. per annum. In any event whether the shift to deposits resulted purely froth force of circumstances, or whether, as seems more, probable, events accelerated an inevitable trendi the amount of money raised in this way grew with extraordinary rapidity. According to figures pro' duced by the Institute of Economic Affairs, the deposits of eleven members of the Finance Houses RA Association increased from f54 million in 1955 to £147.5 million in 1958. (These totals include some moneys other than deposits, but provide indisputable evidence of the general magnitude of the growth which occurred.) Other figures are EA also available, which show that the deposits 01 some of the smaller companies grew relativell 8t much faster during this period, although they Ir mained far less in total volume than those 01 their bigger and older brethren. Since the end of credit restrictions, the biggest industrial banking houses, with one or two r101' able exceptions, have once again seemed to with' 11 draw from any active measures designed to kcer their deposits growing. But this withdrawal 10 be more apparent than real. Almost all of theill are now associated with banks, either as silt? sidiaries, or as affiliates in which banks have sub' A stantial shareholdings. They may, therefore, be ti relying on the known fact of their banking On: 4 nections to attract deposits towards them. It 15 equally likely that with increased capital result ing from bank participation, they may prefer the time being to enlarge their borrowings fro banks and acceptance houses, since credit lines this sort possess the immense advantages of bole flexibility and cheapness. These reasons, if ores' tive, are not mutually contradictory.

In the longer run, however, it seems reasona to expect that all industrial banking houses, an not merely the smaller concerns, will try to P

1

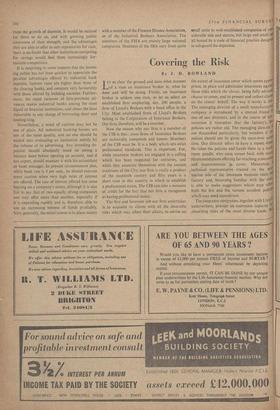

SOME CURRENT TERMS FOR DEPOSITS

FINANCE HOUSES ASSOCIATION

INDUSTRIAL BANKERS ASSOCIATION

Compan,v Period Rates Affiliation Company Period 1 Rates Affiliation

Astley Industrial Trust ... 3 months 5% District Bank Belmont Finance* ... ... 3 months 51% Easterns

6 months 5i%

6 months 6%

Bowrnaker ... ... ... 3 months 4% Lloyds Bank Campbell Discount ... 3 months 51% Minster Trust

5 months 41%

6 months 61%

Forward Trust* ... ... 3 months 4% Midland Bank Capital Finance ... ... 3 months 61%

-

6 months 41%

6 months

Lombard Banking ... ... 3 months 4% — G. and C. Finance* ... 3 months 6% Aberforth

6 months 5%

6 months 7% Investment Cc Mercantile Credit ... ... 3 months 5% Westminster Bank Hermiston Securities ... 3 months 7%

-

6 months 5i% Martins Bank

6 months

North Central Wagon* ... 3 months

3i%

National Provincial Marlborough Finance ... 3 months 61 %

-

6 months 41% Bank

6 months 7%

United Dominions Trust ... 3 months 4% Barclays Bank Milford Mutual Facilities ... 3 months 61%

-

6 months 41%

6 months 71%

" Denotes companies which are whol y-owned subsidiaries of their affiliates.

mote the growth of deposits. It would be natural for them to do so, and with growing public awareness of their strength, and the advantages they are able to offer as safe repositories for cash, there is no doubt that other institutions competing for savings would find them increasingly for- midable competitors.

It is surprising in some respects that the invest- ing public has not been quicker to appreciate the peculiar advantages offered by industrial bank deposits. Interest rates arc higher than those of the clearing banks, and compare very favourably with those offered by building societies. Further- more, the rapid turnover of hire-purchase ad- vances makes industrial banks among the most liquid of financial institutions, and about the least vulnerable to any charge of borrowing short and lending long.

Nevertheless, a word of caution may not be out of place. All industrial banking houses are not of the same quality, and no one shoUld be misled into evaluating an institution merely by the volume of its advertising. Any intending de- positor should absolutely insist on seeing a balance sheet before opening an account, and if not expert, should examine it with his accountant or bank manager. In present circumstances also, while bank rate is 4 per cent., he should exercise some caution when very high rates of interest are offered. The rate of interest offered has some bearing on a company's status, although it is also fair to say that of two equally strong companies one may offer more than another, especially if it is expanding rapidly and is, therefore, able to use an increasing volume of funds profitably. Very generally, the safest course is to place money with a member of the Finance Houses Association, or of the Industrial Bankers Association. The members of the FHA are mainly large national companies. Members of the IBA vary from quite small units to well-established companies of coo (r siderable size and stature, but large and small :t all bound by a code of financial practice designe.J, to safeguard the depositor.

Previous page

Previous page