COMPANY NOTES

By CUSTOS THE Stock Exchange has neve„r before had such a knock as the ort, delivered by Mr. Thorneycroft lay week. The News Chronicle had

headline '12,000,000,000 City Loss.' This was an

exaggeration—the industrial index dropped 8 P cent. and gilt-edged 6 per cent. out of a total Stoo: Exchange corpus of £16,700 million—but it Was certainly the worst two days' slump in history' When the £ went off gold in September, 193' gilt-edged stooks slumped by 8 per cent. In industrial equity shares rose by 9 per cent. oil,, Mr. Thorneycroft's black occasion gilt-edge 'stocks, industrial equities, dollar shares and gala" shares all suffered alike. There was no escape fr°1,1c the knife. The gilt-edged market jobbers we' specially hit because' heavy sales were made 17) the public on Wednesday afternoon and Thursday morning before Bank rate was changed and 111.11.-, stock was still on their books when the sh°",, came. There has been talk of a leakage of.fri formation but the Stock Exchange Coune'!.,,t understand, has decided that there are insullicn grounds for an inquiry. The Government broke: is said to have misled the jobbers by buying stcic right up to the last minute, which, of.course, he

It entitled to do. (Is there any good reason why the 'ace of Government broker should continue,

especially when it is held by a partner of a lead- ing firm of stock brokers?) The Treasury has now ruined its own chances of funding the balance of Ihe £500 million 21 per cent. funding bonds due in November on anything but very expensive terms. A Treasury bill rate of 16 12s. per cent. IS the measure of it. However, the first sign of an imPr3vement of the in the foreign exchange markets brought about some recovery in the gilt- edged market this week. This rally may go farther, Pending political repercussions of the Chancel- lors attack, for I would expect many stocks to loot.

attractive to institutional buyers at these prices. For example, Savings 3 per cent. 1965-75 at 68 to yield 4.4 per cent. gives a 'grossed-up'

redemption yield of 7+ per cent. with fax at 7s. 6d. or 74

has per cent. with tax at 8s. 6d. Historically it

‘,dew as always

!N paid to buy Old Consols at around 45.

history might be made by buying 'Daltons' at 45+ to yield 54 per cent, in perpetuity. The highest running yield on a British Government Stock is now offered by 4 per cent. Consols at 69i---Tnamely £5 16s. 6d. per cent. Sooner or later it will be right to buy the gilt-edged market.

for the industrial equity markets I cannot ay attraction, even after the fall. The perverse As et- a pessimist's argument I put forward last week seems more reasonable .today—that the recent bull movement (from November to July) was merely a secondary reaction in a primary bear market and was brought about simply by panicky hedging against inflation, which will now, if we believe in the Chancellor's success, beconie un- necessary. Certainly I see no reason why our industrial equities should be bought until signs appear that the rise in industrial costs—wage- costs in particular—has been arrested. There are no doubt exceptions to the rule, HEAD WRIGHT- SON, for example, which provides equipment for the capital goods industries, has not varied very much in market price. It forecasts a total dividend of not less than 15 per cent. on the equity capital increased by the issue of one 5s. share for every lOs. (equivalent to 221 per cent. on the old capital). An interim dividend of 5 per cent. is to be paid in January. At 5+ cum 50 per cent. bonus the shares yield nearly 4 per cent. When they are subdivided into shares of 5s. each the market will be broadened.

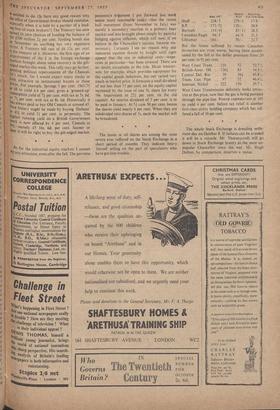

The losses in oil shares are among the most severe ever suffered on the Stock Exchange in a short period of months. They indicate heavy `forced' selling on the part of speculators who have got into trouble.

Present Percernae.

High 1957 Price Fall Irons I bun Shell .. 218/3 179/3 17.9 B.P. 173/71 ' 120 /- • 30.9 Burinah .. 119/44- 85 / 14 28.3 Canadian Eagle 94/3 • 64/9 31.3 Ultramar 104/- 70/- 32.7 But the losses suffered by recent Canadian favourites are even worse, having been accent- uated by the fall in the dollar premium from 20 per cent. to 94 per cent.

West Coast Trans. .. 110 52

52.7.;;,

British-Amer. Oil -.. 1261 83 34.3 Central Del. Rio .. 30 16+ 45.8 Trans. Can. Pipe .. 97 52 46.4 "X.

Internat. Nickel — 222 156

West Coast Transmission definitely looks attrac- tive at this price, now that the gas is being pumped through the pipe-line. POWER CORPORATION at 105 to yield 4 per cent. before tax relief is another first-class utility holding company which has suf- fered a fall of 30, per cent.

* . •

The whole Stock Exchange is dreading settle- ment day on October 8. If failures can be avoided it will be a miracle. Mr. Thorneycroft will go down in Stock Exchange history as the most un- popular Chancellor since the war. Mr. Hugh Dalton. by comparison, deserves a statue.

Previous page

Previous page