THE DEBTORS OF SMACK CITY

On the high streets of Britain credit is instant and generous.

the biggest beneficiary may be the debt collector

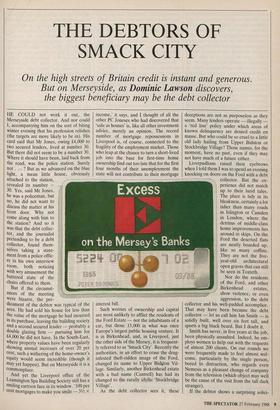

HE COULD not work it out, the Merseyside debt collector. And nor could I, accompanying him on the sort of biting winter evening that his profession relishes (the targets are more likely to be in). His card said that Mr Jones, owing £4,000 to two secured lenders, lived at number 30. But there did not seem to be a number 30.

Where it should have been, laid• back from the road, was the police station. Surely not . ? But as we advanced on the blue light, a mean little house, obviously attached to the station, /- revealed its number – 30. Yes, said Mr Jones, he was a policeman, but no, he did not want to discuss the matter at his front door. Why not come along with him to the station? And so it was that the debt collec- tor, and the journalist pretending to be a debt collector, found them- selves taking a state- ment from a police offic- er in his own interview room, both noticing with wry amusement the battered state of the chairs offered to them.

But if the circumst- ances of the meeting were bizarre, the pre- dicament of the debtor was typical of the area. He had sold his house for less than the value of the mortgage he had incurred in its purchase, leaving the building society and a second secured lender — probably a double glazing firm — pursuing him for £4,000 he did not have. In the South-East, where property values have been regularly showing annual increases of over 20 per cent, such a withering of the home-owner's equity would seem incredible (though it may yet happen). But on Merseyside it is a commonplace. And yet the Liverpool office of the Leamington Spa Building Society still has a smiling cartoon face in its window. '100 per cent mortgages to make you smile — 31/2 x income,' it says, and I thought of all the other PC Joneses who had discovered that `safe as houses' is, like all other investment advice, merely an opinion. The record number of mortgage repossessions in Liverpool is, of course, connected to the fragility of the employment market. Those who leap at the chance to turn a short-lived job into the base for first-time home ownership find out too late that for the first four months of their unemployment the state will not contribute to their mortgage interest bill.

Such worries of ownership and capital are most unlikely to afflict the residents of the Ford Estate — not the inhabitants of a car, but those 15,000 in what was once Europe's largest public housing venture. It is in Birkenhead, and, in Liverpool, just the other side of the Mersey, it is frequent- ly referred to as 'Smack City'. Recently the authorities, in an effort to erase the drug- infested theft-ridden image of the Ford, changed its name to Upper Bidston Vil- lage. Similarly, another Birkenhead estate with a bad name (Cantrell) has had its changed to the rurally idyllic 'Stockbridge Village'. As the debt collector sees it, these deceptions are not as purposeless as they seem. Many lenders operate — illegally a 'red line' policy under which areas of known delinquency are denied credit en masse. But who could be so cruel to a little old lady hailing from Upper Bidston or Stockbridge Village? Those names, for the moment, have no past, even if they may not have much of a future either.

Liverpudlians raised their eyebrows when I told them I was to spend an evening knocking on doors on the Ford with a debt collector. But the ex- perience did not match up to their lurid tales. The place is tidy in its bleakness, certainly a lot tidier than many roads in Islington or Camden in London, where the detritus of middle-class home improvements lies around in skips. On the Ford the deserted flats are neatly boarded up, like so many coffins. They are not the five- yeat-old architectural open graves that can still be seen in Toxteth.

Nor do the residents of the Ford, and other Birkenhead estates, show violence, or even aggression, to the debt collector and his well-padded accomplice. That may have been because the debt collector — let us call him Ian Smith — is solidly built, well over six feet tall, and sports a big black beard. But I doubt it.

Smith has never, in five years at the job, been physically assaulted. Indeed, he em- ploys women to help out with the requests of almost 200 clients. On our rounds we were frequently made to feel almost wel- come, particularly by the single person, bored to distraction, who regards even Nemesis as a pleasant change of company from the television (which object may well be the cause of the visit from the tall dark stranger).

If the debtor shows a surprising solici- tude for the predicament of the collector, it may well be because he has done a spot of `trade protection' himself. A two-and-a- half-hour shift of door-knocking on Merseyside will pay the financial canvasser about £20, on an averagely successful night, and is exactly the sort of moonlight- ing work which the over-borrowed factory worker can do with. It is also being sponsored, probably unwittingly, by the state. In his time Ian Smith has taken on young people from agencies operating under the financial umbrella of the Man- power Services Commission, and on odd occasions, even Youth Training Scheme youngsters; it seems that the MSC `trainees' see debt collecting as far more fun than travelling to the same estates with the idea of painting a house with one brush between five would-be decorators (a scene described to me by one rather disen- chanted former MSC scheme organiser in Liverpool).

The most extraordinary thing that the trainee Scouse debt collectors will find although they may not recognise how odd it is — is that none of the debtors ever asks the obvious question: 'How much do I owe?' On my rounds I never heard what self-preservation would suggest as an auto- matic response, and Ian Smith said that my experience was absolutely typical. All the Merseyside debtors say is: 'We can afford to pay £x a month' — presumably into the infinite future.

This attitude had a kind of weird logic in the days of Hire Purchase payments: they were in fixed instalments, and if you couldn't make them, then the Repo man would come and take the television, or whatever, away. But in these days of instant credit and Annual Percentage Rates the amount owed actually grows in the event of under-payment. The retailer does not want your television back, he just wants his money.

To walk around the shopping centre of Liverpool is to see how the retailer con- vinces those who should stay in the rental market to become owners. Every window seems to advertise Instant credit'. Even Owen Owen, whose eponymous founder said, on his arrival in Liverpool in 1865, `The guide to the harbour of best success is to give no credit to anyone for longer than two months,' is now offering `up to £1,250 credit to spend immediately'. The repay- ment rate is a savage 34.4 per cent, or over three times the rate at which Messrs Owen Owen can themselves borrow on the open market.

At the time I was knocking on PC Jones's borrowed front door, the Rt Hon. Robin Leigh-Pemberton, Governor of the Bank of England, was lecturing the lumi- naries of the provincial newspaper industry on the dangers of the explosion in personal credit in Britain. Over the port and cigars the Governor noted that bank lending to the personal sector had grown by 50 per cent over the past two years, and that personal sector borrowing had for years been rising faster than personal incomes.

One does not have to be the Governor of the Bank of England — or indeed the Governor of the Bank of England's speechwriter — to observe that 'this may well lead to an increasing number of individual borrowers having difficulty in servicing their debt'.

It is equally clear that the British clear- ing banks, recoiling from the billions of pounds they have lost through filling their loan books up with South American debt in the 1970s, have decided that the safest way to make a turn on the money they borrow (or merely take) on Britain's high streets is to send it back whence it came, albeit at much higher rates and preferably secured on property.

But it is axiomatic that bankers — once described as marble brains upon marble floors — always stampede for the same ashionable business, and feel compelled by the force of that competition to make loans which subsequently do not bear the strictest examination.

Retailers such as Owen Owen doubt- less judge that the rate of credit they charge amply compensates them for a high rate of default. For their methods of assessment are frequently irresponsible. Most will give credit to any one displaying a valid credit card, with no means of knowing whether the person waving the Visa card is in fact the true owner of the plastic. If they do make a checking tele- phone call it will be to the computerised records of the lists of debtors in the County courts. But these may well be out of date, and represent only the hard core of likely defaulters.

In Liverpool those financial delinquents are merely taking their cue from those they once elected to manage their affairs. The city is now struggling to find a way of if you show me your Aids leaflet, I'll show you mine.' meeting the £50 million shortfall between its rate-capped income and the expenditure needed to maintain services at their pre- sent levels. And about a quarter of next year's capital allowance from the Govern- ment of £46 million will go towards the repayment of some hair-raising financing incurred by Messrs Hatton and Byrne. They financed their improvements to the municipal housing stock by borrowing from Japanese and Swiss banks, on the cute terms of a two-year moratorium fol- lowed by repayment over the next five (now). Even the Leamington Spa Building Society would not expect its Liverpool clients to buy that.

Gary Lane is an ex-merchant seaman who has lived in the former great seaport of Liverpool for 30 years and last year published Liverpool: Gateway of Empire (Lawrence and Wishart). He has summed up the character of the place: Liverpud- lians, he says, have `a cavalier disregard for money. This is a city with the habit of the seafarer ashore after a voyage — spend it while you can, because the world might end tomorrow. Strangers cannot help but notice the astonishing number of London- style black cabs on the streets. For where in the Metropolitan Police District of London there is one cab for every 522 persons, in Liverpool there is one for every 360. Such an elementary statistic encodes the peculiarity of Liverpool.'

`Don't look only for the bad things here,' the Conservative Party agent in Liverpool told me. 'Go down to the Albert Dock and look at what government support has helped to build.' So down the hill to the dock I walked, in the face of the kind of salty gale which explains why the waiting list for adenoidal surgery in the Mersey area is the longest in the country.

There, at Albert Dock, were all the accepted accoutrements of subsidised urban renewal, from art galleries to Mex- ican restaurants. By the edge of this Fulham-on-Mersey was a statue dating from the City's great days as the entrepot of transatlantic capitalism. 'Enterprise', it said, and I followed its gaze across the Mersey to the Cammell Laird shipyard at Birkenhead. I could not make out any activity, because there was none. The 1,500 workers had been locked out, follow- ing their demand for more pay as a reward for clocking in with electronic tags rather than by the traditional manual method.

Easy to draw a vivid contrast between the entrepreneurial strivings at Albert Dock and the sullen self-destructiveness of the wage-slaves across the watery divide. But my first thought was of how many of the men at Cammell Laird had recently encountered my friend the debt collector, or one of his less scrupulous rivals, and that they were hoping to use the electronic identity tags as a means of meeting too- long deferred payments for other state-of- the-art electronic gadgets at home on the Ford Estate.

Previous page

Previous page