INVESTMENT NOTES

By CUSTOS THE faith of investors does not appear to be easily shaken. The alarming international news has, of course, depressed the security mar' kets, but continuing faith in the long-term future, Of our industrial leaders is expressed by the yield of 4.4 per cent. on ROLLS-ROYCE at 90s. 6d. In spite of a 14 per cent. rise in turnover net profits were not much higher than in the two previous years and equity earnings were only about twice the amount of the 20 per cent. dividend. Heavy writing-down of the vast capital expenditure prevents profits from rising more and one of these days shareholders may get their reward, but the shares are not cheap either on dividend or earn' ings yield standards.

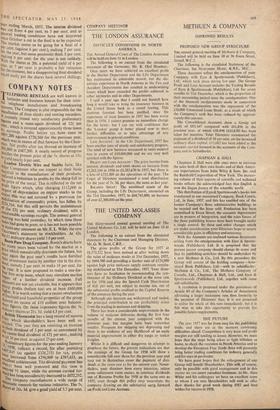

Marks and Spencer This chain store does not exactly fit into the group of consumer goods shares that I have lately been recommending, but as long as the present management remains in control there is no reason why an investor should ever turn it out of his portfolio. In good times and bad Sir Simon Mar/0 and his brilliant executive team manage to shoW outstandingly good results. The year ending March was not an easy year but turnover was in' creased by 4 per cent, and net profits by 10 Per,, cent. Earnings on the equity capital rose by ly per cent. to 57f per cent. and with the new profits tax may be calculated at well over 60 per cent' Earnings on the real capital employed in the business rose from 19 per cent. 'to 23 per cent. The dividend was stepped up 2f per cent, to 321 per cent., and although the bulls were disappointed the shares at 42s. 3d. to yield 3.85 per cent. on a diV, dend nearly twice covered may be considered fairly priced for a 'growth' share. 'Growth' in this case depends upon an annual increase in counter, space for the sale of goods. The chairman should have something to say at the meeting on June /6 about the results of the 'lower prices' sales care' paign and if he is optimistic the shares will prob' ably hold their price. If he is pessimistic, which would be unusual, there may be some switching into WOOLWORTH shares, which at 38s. 6d. return the higher yield of 5.15 per cent. If MARKS AND, SPENCER then fall to yield 4 per cent, they should be bought.

Courtaulds A correspondent has asked me for my opinion of COURTAULDS, which he thinks paid too high a price for the acquisition of Celanese. He maY well be right, for the directors, in reviewing the first half of the year which had resulted in a reduction of profits despite the increase in hone market prices, stated at the end of October that unless there was a substantial improvement In trading conditions the group profits for the year ending March would be 'significantly less' than the combined profits of the two companies for the Year ending March, 1957. The interim dividend was cut from 4 per cent. to 3 per cent, and as general trading conditions have not improved since October a cut in the final is to be expected. The market seems to be going for a final of 4 Per cent, (against 6 per cent.), making 7 per cent. for the year, but some pessimists think 3 percent. Making 6 per cent. for the year is not unlikely. With the shares at 20s. a potential yield of 6 per cent, or 7 per cent. is probably a fair valuation for the moment, but a disappointing final dividend could easily put the shares back several shillings.

Previous page

Previous page