The only Western oligarch in Moscow

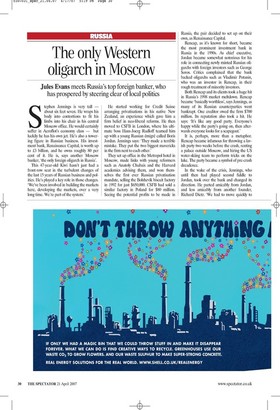

Jules Evans meets Russia’s top foreign banker, who has prospered by steering clear of local politics Stephen Jennings is very tall about six feet seven. He wraps his body into contortions to fit his limbs into his chair in his central Moscow office. He would certainly suffer in Aeroflot’s economy class — but luckily he has his own jet. He’s also a towering figure in Russian business. His investment bank, Renaissance Capital, is worth up to £3 billion, and he owns roughly 80 per cent of it. He is, says another Moscow banker, ‘the only foreign oligarch in Russia’.

This 47-year-old Kiwi hasn’t just had a front-row seat in the turbulent changes of the last 15 years of Russian business and politics. He’s played a key role in those changes. ‘We’ve been involved in building the markets here, developing the markets, over a very long time. We’re part of the system.’ He started working for Credit Suisse arranging privatisations in his native New Zealand, an experience which gave him a firm belief in neo-liberal reforms. He then moved to CSFB in London, where his ultimate boss Hans-Joerg Rudloff teamed him up with a young Russian émigré called Boris Jordan. Jennings says: ‘They made a terrible mistake. They put the two biggest mavericks in the firm next to each other.’ They set up office in the Metropol hotel in Moscow, made links with young reformers such as Anatoly Chubais and the Harvard academics advising them, and won themselves the first ever Russian privatisation mandate, selling the Bolshevik biscuit factory in 1992 for just $650,000. CSFB had sold a similar factory in Poland for $80 million. Seeing the potential profits to be made in Russia, the pair decided to set up on their own, as Renaissance Capital.

Rencap, as it’s known for short, became the most prominent investment bank in Russia in the 1990s. As chief executive, Jordan became somewhat notorious for his role in connecting newly minted Russian oligarchs with foreign investors such as George Soros. Critics complained that the bank backed oligarchs such as Vladimir Potanin, who was an investor in Rencap, in their rough treatment of minority investors.

Both Rencap and its clients took a huge hit in Russia’s 1998 market meltdown. Rencap became ‘basically worthless’, says Jennings, as many of its Russian counterparties went bankrupt. One creditor owed the firm $700 million. Its reputation also took a hit. He says: ‘It’s like any good party. Everyone’s happy while the party’s going on, then afterwards everyone looks for a scapegoat.’ It is, perhaps, more than a metaphor. Rencap became infamous for throwing a lavish party two weeks before the crash, renting a palace outside Moscow, and hiring the US water-skiing team to perform tricks on the lake. The party became a symbol of pre-crash decadence.

In the wake of the crisis, Jennings, who until then had played second fiddle to Jordan, took over the bank and changed its direction. He parted amicably from Jordan, and less amicably from another founder, Richard Dietz. ‘We had to move quickly to gain credibility fast. So we had tough decisions to make.... We had to preserve the bank, it was a sheer matter of survival.’ He decided to try to set up Russia’s equivalent of Goldman Sachs, with employees owning equity, an emphasis on professionalism and a big proprietary trading book. Rencap is now one of the two top local brokerage firms in Russia (the other being Troika Dialog) and made $300 million net profit last year. Defying conventional wisdom, it has stayed independent while beating Western investment banks at their own game.

That’s partly because both Rencap and Troika have been prepared to pay huge salaries to lure top bankers from the likes of Deutsche Bank and UBS, which are haemorrhaging staff at an alarming rate in Moscow. A managing director at either of the two Russian market leaders can hope to earn between $3 million and $15 million, a lot more than they can at a bank like Deutsche, which has limits set by Frankfurt on its bonuses.

Rencap’s headcount went up 60 per cent last year, and is set to rise by another 50 per cent this year, bringing numbers in Moscow up to 1,000. With all the highly paid new talent running around, the atmosphere in the firm is intensely competitive — like Jennings himself. He cares deeply, for example, about magazine awards, and annually packs the research team off on a gruelling global campaign to make sure they win the Institutional Investor awards for best Russian research, which they invariably do. He once had a stand-up row with Euromoney chairman Padraic Fallon when Euromoney failed to give Rencap the award for best Moscow brokerage, and the two have barely spoken since.

At the same time, Jennings retains something of the Kiwi neo-liberal beneath the Moscow dealmaker. ‘I would wager against Russia remaining authoritarian. Russia is an incredibly open country. It’s terribly exposed to ideas and people and trade and products. It’s going to be tremendously prosperous. With that prosperity will come increased demand for services, which includes political services.’ He says this process is already underway: ‘Business is getting stronger, and is pushing for better regulation.’ Again, Rencap is involved in this process. The most powerful business lobby in Russia, the Russian Union of Industrialists and Entrepreneurs, is run by Alexander Shokhin, who used to be chairman of Rencap’s supervisory board.

But Jennings himself is careful to stay out of Russian politics, which includes not being too close to any particular Kremlin clan. ‘I don’t think being too close to government is a viable medium-term strategy. It’s actually quite a risky one. We don’t want to be very political.’ The lesson of Boris Jordan, who was accused by the Russians of working for the CIA and by the Americans of working for the KGB, is no doubt still fresh in his mind.

Success in Russia is apparently not enough for him. He is now trying to build ‘the dominant investment bank in sub-Saharan Africa’ as well — and travelling to Nigeria every ten days. He thinks sub-Saharan Africa is ‘the region that will most outperform people’s expectations over the next 20–30 years’.

Perhaps Russia is becoming too civilised and boring for him. ‘He’s a wild man,’ says another Moscow banker. ‘He can drink anyone in Moscow under the table.’ I ask Jennings if it’s true that security once asked him to leave a Renaissance party after he got slightly too boisterous. ‘I don’t think they asked me,’ he laughs.

Jules Evans is Moscow business correspondent of the Times.

Previous page

Previous page