Investment Notes

By CUSTOS LAST week was responsible for a sharp re- covery in the gilt-edged market after its con- tinued slide. Both TREASURY 51 per cent., 2008-12, and 31 per cent. WAR LOAN improved by I and the market generally looked to be holding its own. Last Friday was not only the last day of the account but was also the last day of dealing for settlement in the current financial year for some firms and institutions. Looking at a number of recently published insurance com- pany accounts, it is noticeable that they have in- creased their stake in gilt-edged and fixed interest stocks, for, as I mentioned last week, the average professional investor considers that equities are still too dear. The downturn on Wall Street which has been evident since mid-February was reversed by a steady daily climb accounting for a 12.71 rise on the week in the Dow Jones In- dustrial Index. The dollar premium at one time touched 101 and finished 1 up at 91.

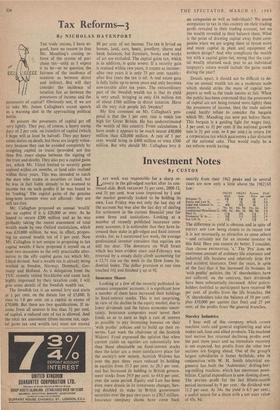

Insurance Shares Looking at a few of the recently published in- surance companies' accounts, it is significant how a number of them have increased their holdings in fixed-interest stocks. This is not surprising, in view of the decline in the equity market, due to lower dividends and the future economic uncer- tainty. Insurance companies must invest their funds so as to earn as high a rate of interest as possible to pay increasing bonuses on their `with profits' policies and to build up their re- serves. Last week the chairman of the Scottish Widows' Fund expressed the opinion that when current yields on equities are substantially less than those obtainable on fixed-interest stocks then the latter are a more satisfactory place for the society's new money. Scottish Widows has over the past three years reduced its holding in equities from 35.3 per cent. to 28.3 per cent. and has increased its holding in British govern- ment stocks from 39.9 per cent. to 44.0 per cent. over the same period. Equity and Law has been even more drastic in its investment changes, hav ing doubled its stake in British government securities over the past two years to £30.5 million. Insurance company shares have come back smartly from their 1962 peaks and in several cases are now only a little above the 1962/63 low:

1962/63 1962/63 Present Yield

High Low Price per cent

Britannic 5s. 3.3

Equity and Law 5s. ... 9 5/ 2.0 Legal and General 5s. ... 481 32/ 36 1.3

London 5s. ... 70s. 6d. 45s. 9d. 51s. 6d. 3.3 London and Manchester 5s. 140s. 9d. 88s. 3d. 98s. 9d. 2.4 Pearl 5s. 13* 10; 11/ 3.5 Prudential 'A' 4s.... ... 291 21; 251 2.9 Sun Life 5s. l5I 9 121 1.6

The difference in yield is obvious and in spite of EQUITY AND LAW being closest to its recent low it is not necessarily as attractive as some others -and certainly not for an income investor in this field. Here you cannot do better, I consider, than choose PRUDENTIAL 'A.' The 'Pm' does an enormous amount of ordinary life assurance and industrial life business and relatively little fire and accident insurance. Over the years, in spite of the fact that it has increased its business in 'with profits' policies, the 'A' shareholders have not suffered; on the contrary, their dividends have been substantially increased. After policy- holders (entitled to participate) have received 90 per cent. of profits from the life branches, the 'A' shareholders take the balance of 10 per cent. plus £10,000 per annum (tax free) and 25 per cent. of the profits from the general branches.

Staveley Industries I hear well of this company which covers machine tools and general engineering and also makes salt, lime and allied products. The machine tool section has returned declining profits over the past three years and an immediate recovery is not expected, but profits from the other two sections are forging ahead. One of the group's largest subsidiaries is James Archdale, who in conjunction with W. H. Smith (electrical en- gineers) has built the `Autoncimic' drilling-bor- ing-milling machine, which has enormous possi- bilities. Capital expenditure is now slowing down, The pre-tax profit for the last fifteen-month period increased by 9 per cent.; the dividend was 11.2 per cent. At 34s. the yield is 6.5 per cent., a useful return for a share with a net asset value of 43s. 8d.

Previous page

Previous page