MONEY MARKET.

The Money Market has been subject to several convulsions during the past weak; a rapid decline in the price of Consols having occurred on two ocea- aims.; but the depression in either case was not of long continuance, and the English Fends have this afternoon nearly recovered their ground. The poli- tied aspect of affairs at home and in France may he cited as the cause of these seventy. Neither must we omit in our calculation the quantity of Stock eseated by the West Indian Indemnity Loan, which has a tendency to encourage areataters in their operations for the fall. The demand for Money Stock is oti2 sorb as to cause its quotation to be ath above the price for Account. The difference will doubtless continue until the period when the receipts of the new Loan are issued ; at which time the amount paid up into Stock (said to be room than three millions) will be thrown upon the market, and the immediate &island supplied. The Foreign Market has not been exempt from the fluctuations to which we kat alluded in our report of the English Funds. The market fur Cortes Bonds Lao been depressed by some very considerable sales, and the price has been as low as 441: from that point, however, an improvement has taken place, and the Last quotation is 464 The recent intelligence from Spain is of a favour- able character, but the holders of the Stock seem always anxious to take what.. over opportunities the market affords to sell. Considerable quantities of Stock ilife thus from time to time thrown upon the market ; and hence the sudden &Fa to which it is subject, and the very gradual nature of its improvement. The European Continental Stocks have not been affected, and the prices are zaarly the same as in our last. An impulse of 2 per cent. has to-day been given to the various South Ame- rican Stocks, it being alleged that the recognition of the new Republics by Spoils will be speedily announced. But whatever effect this measure may pro- &tee upon the price of these Securities, we should think it can be but tem- porary; as this single formal act of the Spanish Government can neither supply tie- exhausted treasuries of the Republics, nor infuse into their proceedings the werressary spirit of good government, in which they are at present so lamentably ditieient.

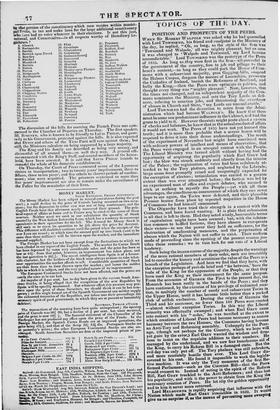

SATURDAY, TWELVE O'CLOCK The transactions of the morning have been quite unimportant ; the opening pone of Consuls was 894 90, but a decline of i per cent. has since occurred, asei the price is now 694 i. The financial statement of the Chancellor of the Exchequer has not produced any effect upon the price of the Funds. In the Foreign Market, the Spanish Cortes Bonds are at improved quotations, the price being 47i i, and that of the Scrip 124 12i dis. Portuguese Stocks are at yesterday's prices ; the other European Continental Stocks are also on- e:ganged. South American Securities are firm at the improved prices of yes- tualay. a rer Cent. Consols 99j 90 Dutch 21 per Cents 544 biltio far Account :491 I French 3 per Ceuts - New 34 per Cent. Annuities 98 4 Greek, 18.'5.5 per Cents - PAW Stock for Account .... 2544 Mexican 6 per Cents. 351 Biehaaper Hilts 20 22pm. Portuguese 3 per Cents 561 7*

Osaaiam - Do. Regency 3 per Cent 894

.19,402 6. pat Cents. ex. div. 1004 Russian, 1822, 5 per Cent 1094 4 acwaidiao 5 per Cents... .. .. 851 4 Spanish. 1821. 5 per Cent 571 4 6inisioh 3 per Cents 764 7 Ditto New Scrip 5 Cent.... 124 12dis.

Previous page

Previous page