COMPANY NOTES

ALBERT E. REED. The preliminary figures from this company for the year ending March 31, 1958, were not as disappointing as might have been expected after the gloomy interim dividend statement of last October. In fact the total divi- dend of 14 per cent. from earnings of 23.2 per cent. is only a reduction of 2 per cent. on the previous year. Group profits were £4,500,596 against £5,691,434 and net profits after tax £2,176,996 against £2,579,545. This reduction in profits Was fully expected in view of the falling demand for newsprint and allowing for the increased expenses that must have arisen in respect of starting up the new plant and machinery at Aylesbury and Colthrop, which cannot, as yet, be fully employed. Whether the Chairman will have anything optimistic to say about the im- mediate future of the paper industry at the annual general meeting in July remains to be seen. The £1 ordinary units at 33s. to yield 8f per cent. seem fairly valued.

Selection Trust has declared a final dividend of 521 per cent. to make 70 per cent. for the year ended March 31, 1958, which fulfils the hopes of the Chairman, Mr. Chester Beatty, on the capital increased by last year's one for twenty-five share issue. Considerably reduced group profits were expected, on the lower base metal prices which are down from £4,566,691 to £3,127,366; but there is a consequent fall in the tax charged of £717,851, so that net profits come out at £1,506,230 against £2,821,878. The subsidiary company, Seltrust, which has important interests in American Metal and African Selection Trust, has naturally con- tributed lower profits, the payment to the parent company being cut from £1,635,156 to £1,074,531. The chairman's forecast on the base metal outlook is awaited with keen interest. In the meantime the 10s. ordinary shares are keeping very firm at 77s. 6d. to yield 9 per cent.

Forestal Land is a company with an erratic record over the years. Following on an improve- ment in the last year or so, Sir Gerard d'Erlanger, the Chairman, does not expect any serious deterioration in profits. The company's interests are mainly in tanning extracts—quebracho and mimosa, in which it obtained an increased share in world markets, the lower price ruling being offset by a greater tonnage. The net profit for the year of £766,244 shows an increase of £131,331, a major portion of which is being retained in the accounts of the subsidiary companies. In order to maintain the dividend, £275,000 has been trans- ferred from general revenue reserve, but from the year'S- trading as much as £412,072 has been ploughed back into the business. Shareholders

may have to wait another year for results on the programme to diversify the company's interests. It seems reasonable to expect the maintenance of the 8 per cent. dividend, so that the £1 ordinary shares at 14s. 9d. give a yield of 12.2 per cent.

R-F.D., the manufacturer of rubber life-saving rafts (now compulsory equipment for most sea- going vessels), has produced its accounts for 1957 in a new form which is of interest and an improve- ment on past years. Net profits are £135,530, to which should be added £65,509 in respect of a final payment for the company's fire insurance claims. After tax there remains a surplus of £125,799, from which reserves 'receive £65,000. The final dividend is 11 per cent., making 17 per cent. for the year. The Chairman, Mr. Henry F. Spencer, advises that there has been a large increase in stock and working progress, which should prove a valuable selling line, but competition is un- doubtedly increasing. It is worth noting that the company has recently secured a contract from the Royal Canadian Navy, valued at approximately £250,000. The 2s. ordinary shares at about 5s. appear fully valued at present to yield 6.8 per cent.

F. Francis and Sons. The Chairman, Mr. Frank Fox, reported another very satisfactory year for 1957, although the Group trading profit at £396,738 was a little lower than that of £439,624 for 1956, and after tax was £161,743. General Reserve now stands at £515,000 and an amount of £153,389 is carried forward by the Holding Com- pany which is just over twice the amount required to pay the total dividends on the preference and ordinary share capital. An ordinary dividend of

20 per cent, has again been paid; prospects for the current year appear promising as production throughout the Group, for the first four months of this year, shows an increase on the correspond- ing period of last year. The company's principal subsidiaries manufacture and sell many kinds of cork products (bottle closures, etc.) through The Defiant Crown Cork Company and also manu- facture Keighley Lifts. An extract from the Chairman's Statement to Shareholders at the Annual General Meeting held on June 10 appears on the previous page. The 5s. ordinary shares are 14s. to yield 7.1 per cent. Mr. E. A. Mitchell, Chairman of Chubut Tea, reports that 1957 was not a good cropping year for the company, in fact the crop was the smallest for nine years. A higher standard of plucking, however, did enable the company to obtain above the average price for Dooars teas at the London auctions. Profits, by reason of lower tea prices, fell to £63,713, which figure is reduced to £42,630 after tax. The Annual General Meeting will be held on June 24; an extract of the Chairman's speech appeared in our issue of June 6. The £1 ordinary shares are priced at 10s. 9d. to yield 9.3 per cent.

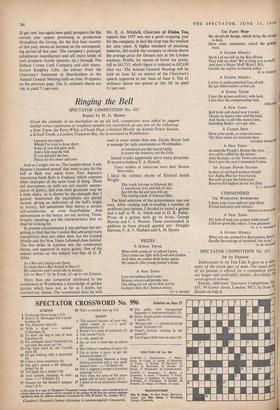

Previous page

Previous page