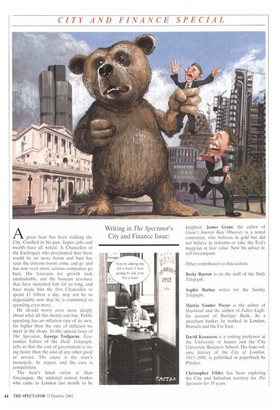

Writing in The Spectator's City and Finance Issue: A great bear

has been stalking the City. Crushed in his paw, hopes, jobs and wealth have all wilted. A Chancellor of the Exchequer who proclaimed that there would be no more boom and bust has seen the dotcom boom come and go and has now seen more serious companies go bust. His forecasts for growth look unattainable, and the buoyant revenues that have sustained him for so long, and have made him the first Chancellor to spend £1 billion a day, may not be so dependable now that he is committed to spending even more.

He should worry even more deeply about what all this money can buy. Public spending has an inflation rate of its own, far higher than the rate of inflation we meet in the shops. In this special issue of The Spectator, George Trefgarne. Economics Editor of the Daily Telegraph, tells us that the cost of government is rising faster than the cost of any other good or service. The cause is the state's monopoly, he argues, and the cure is competition.

The bear's latest victim is Alan Greenspan, the adulated central banker who came to London last month to be

knighted. James Grant, the editor of Grant's Interest Rate Observer, is a noted contrarian, who believes in gold but did not believe in dotcoms or take the Fed's magician at face value. Now his advice is: sell Green spans.

Other contributors to this section: Becky Barrow is on the staff of the Daily Telegraph.

Sophie Barker writes for the Sunday Telegraph.

Martin Vander Weyer is the editor of Heartland and the author of Fallen Eagle, his account of Barclays Bank. As a merchant banker he worked in London, Brussels and the Far East.

David Kynaston is a visiting professor at the University of Sussex and the City University Business School. His four-volume history of the City of London, 1815-2000, is published in paperback by Pimlico.

Christopher Hides has been exploring the City and Suburban territory for The Spectator for 35 years.

Previous page

Previous page