Making room for Tecalemit

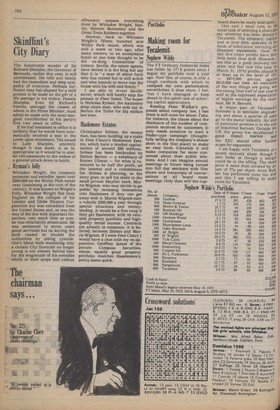

phew Wild

The FT Ordinary Industrial index has fallen by 117.8 points since I began my portfolio over a year ago. Now this, of course, is only a rough yardstick with which to compare my own performance; nevertheless it does show, I feel, that I have managed to keep ahead in the uphill task of achieving capital appreciation.

Reading Peter Walker's proposals about company law, I feel there is still room for abuse. Take, for instance, the clause about the disclosure of the number of corn-• plaints received by customers. 1,t• only needs someone to start a • Nader-type campaign (thoughtfully selling the company's shares short in the first place) to make' an easy buck. Certainly it will make companies far more concerned about their public relations. And I can imagine annual meetings in future being turned into full day seminars with film shows and transcripts of conver, sations at all board room meetings. Only then will the cup board doors be really held open.

l'his said I must turn to the, usual task of selecting a share anv my attention has been drawn rv Tecalemit. The company, capital' ised at over £4m, operates in the fields of lubrication, servicing aart filtration equipment. Over the last five years profits have done little more than drift. However. I see this as a good recovery situ. ation and feel that this year (tv March 31, 1974) profits should be, at least up to the level of 197! — 1,874,000 pre-tax against £610,000 last time. An indication of the way things are going was the strong final half of last year as well as the expressed expectation of higher earnings by the chairman, Mr N. Bennett.

A major part of Tecalemit's business is in specialist engineering and about a quarter of sales go to the motor industry. An area of particular promise is in the sale of industrial burners. Outside the UK the group has established 3 good export market.: and

the EEC should offer further scope for expansion.

I am happy with Tecalemit as sound recovery share though it also looks as though a merger could be in the offing. The share price is more than covered by as' sets of 77p per share. Avon Rubber has performed none too well and this I am selling to make room for Tecalemit.

Previous page

Previous page